In the fast-paced world of trading and investments, every rupee counts. Whether you’re a seasoned investor or just starting, understanding how your trades translate into profits—or losses—is essential. One tool that has proven indispensable to modern traders is the brokerage calculator. By offering a transparent breakdown of costs associated with each trade, a brokerage calculator enables traders to make informed decisions, optimize their investment strategies, and ultimately maximize their returns.

The Importance of Knowing Your Trading Costs

When you enter the stock market, your goal is simple: grow your wealth. However, many investors overlook a critical factor—trading costs. These costs can include brokerage fees, securities transaction taxes (STT), goods and services taxes (GST), exchange charges, and stamp duties, all of which can eat into your potential profits. A brokerage calculator simplifies this process by calculating the total charges, allowing you to see exactly what you’ll pay for each transaction before you place it.

For example, if you’re investing in equities or derivatives, the cost breakdown is more complex than just the price of the shares. Brokerage fees can vary based on the type of trade, whether it’s intraday trading or delivery, and the volume of shares traded. Additional taxes and charges might apply depending on the trade value, further complicating the calculation. Here’s where a brokerage calculator becomes invaluable: it removes the guesswork and provides a clear snapshot of your total costs and expected profits.

How a Brokerage Calculator Works

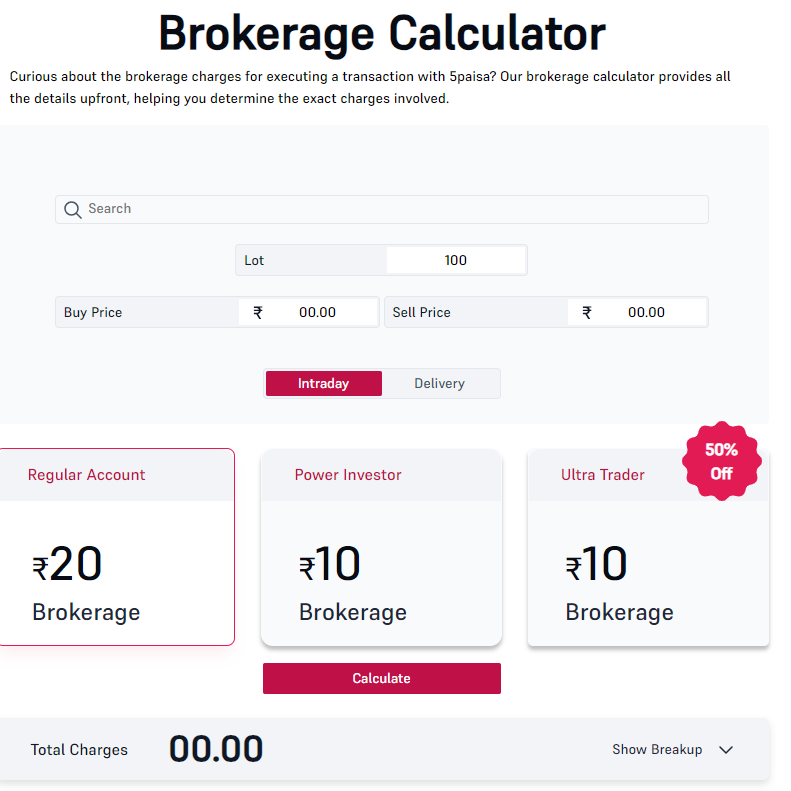

Using a brokerage calculator is simple. All you need to do is input the details of your trade—such as the buy and sell prices, the number of shares, and the type of transaction (intraday or delivery). The calculator will instantly generate the total cost, including all the associated fees and taxes, and provide you with the net profit or loss. This level of transparency helps traders make more accurate decisions, as they can see how each factor influences their bottom line.

For instance, let’s say you’re planning to purchase 100 shares of a company at ₹500 each and sell them later for ₹550. You would enter these values into the brokerage calculator, which would then provide a breakdown of the brokerage fee, exchange charges, taxes, and the net gain or loss from the trade. With this information in hand, you can evaluate whether the potential profit is worth the cost.

Why Every Trader Should Use a Brokerage Calculator

- Transparency: A brokerage calculator offers complete transparency regarding the costs involved in every trade. Whether you’re investing in stocks, mutual funds, or commodities, knowing exactly what you’ll pay is crucial for making well-informed decisions.

- Better Trade Planning: With the help of a brokerage calculator, you can plan your trades more effectively. By factoring in all costs, you can calculate the breakeven point and assess the true profit potential of each investment.

- Tax and Fee Awareness: Brokerage calculators don’t just show brokerage fees; they also account for taxes, such as the Securities Transaction Tax (STT), and other charges. This ensures that traders are fully aware of all the financial implications before executing a trade.

- Saving Time: Instead of manually calculating each fee and charge for every trade, a brokerage calculator instantly does the math, saving valuable time and allowing traders to focus on what matters—analyzing the market and making profitable trades.

- Avoiding Hidden Costs: One of the biggest challenges for novice traders is underestimating the impact of hidden fees on their returns. By using a brokerage calculator, traders can avoid unpleasant surprises and prevent fees from eating into their profits.

Types of Traders Who Benefit Most from Brokerage Calculators

While every investor can benefit from using a brokerage calculator, some traders find it particularly essential:

- Day Traders: Intraday trading involves high-volume trades with smaller profit margins. Knowing the exact cost of each trade ensures that even minimal gains are worth the effort.

- Swing Traders: For those who hold stocks for a few days or weeks, the ability to calculate costs accurately ensures that the potential profits outweigh the trading fees.

- Long-Term Investors: Although long-term investors make fewer trades, understanding the costs associated with large trades or diversified portfolios can help maximize returns over time.

Calculating the Hidden Impact of Brokerage Fees on Your Portfolio

Even a small difference in brokerage fees can have a significant impact on the overall growth of your portfolio. Let’s say you consistently pay 0.5% in brokerage fees, which may not seem like much. But over time, as your investments compound, these costs can add up, eating into your returns. For example, on a portfolio worth ₹1,00,000, a brokerage fee of 0.5% would cost you ₹500. If you make several trades, this fee can quickly escalate.

A brokerage calculator helps you evaluate these costs beforehand, giving you the opportunity to optimize your trading strategies. For long-term investors, minimizing unnecessary fees is just as important as selecting the right stocks or funds.

Additional Tools for Investors: Exploring Investment Calculators

In addition to brokerage calculators, investment calculators are another invaluable tool for investors looking to make informed financial decisions. These calculators help you project the future value of investments, estimate returns, and understand the impact of various factors, such as interest rates, on your portfolio.

For instance, an SIP (Systematic Investment Plan) calculator allows you to calculate the potential returns of investing a fixed amount of money at regular intervals in mutual funds. Similarly, retirement calculators can help you estimate how much you need to save each month to reach your retirement goals, while loan calculators can break down your monthly payments and total interest costs for mortgages or personal loans.

How Investment Calculators Help Maximize Financial Growth

- Goal Setting: Investment calculators enable you to set clear financial goals by projecting the growth of your investments over time.

- Planning for the Future: Whether you’re saving for a home, a car, or your child’s education, an investment calculator helps you determine how much to save and for how long.

- Optimizing Returns: With the help of an investment calculator, you can compare different investment options and choose the one that maximizes your returns with minimal risk.

- Risk Assessment: By allowing you to factor in variables like inflation and market volatility, investment calculators give you a clearer picture of the potential risks and rewards of your investment strategy.

Conclusion: Making Smart Investments with 5paisa

In a world where financial decisions are becoming increasingly complex, tools like brokerage calculators and investment calculators are essential for anyone looking to maximize their returns and minimize their costs. Whether you’re a day trader making multiple trades a day or a long-term investor building your portfolio for retirement, these calculators provide invaluable insights into the true cost and growth potential of your investments.

For traders and investors alike, leveraging a brokerage calculator ensures that you’re not leaving money on the table due to hidden fees or taxes. And when it comes to choosing an investment platform that offers a seamless, transparent experience, 5paisa stands out as a leading option, offering tools and resources that empower users to make smarter, more informed decisions.

So, if you’re looking to optimize your trades and grow your wealth, start using brokerage and investment calculators today—and experience the difference they can make in your financial journey with 5paisa!